Every Dollar Deducted, is Another Dollar Earned

Take control of your finances

Deduct more expenses

Pay less taxes

Rental property expense management.

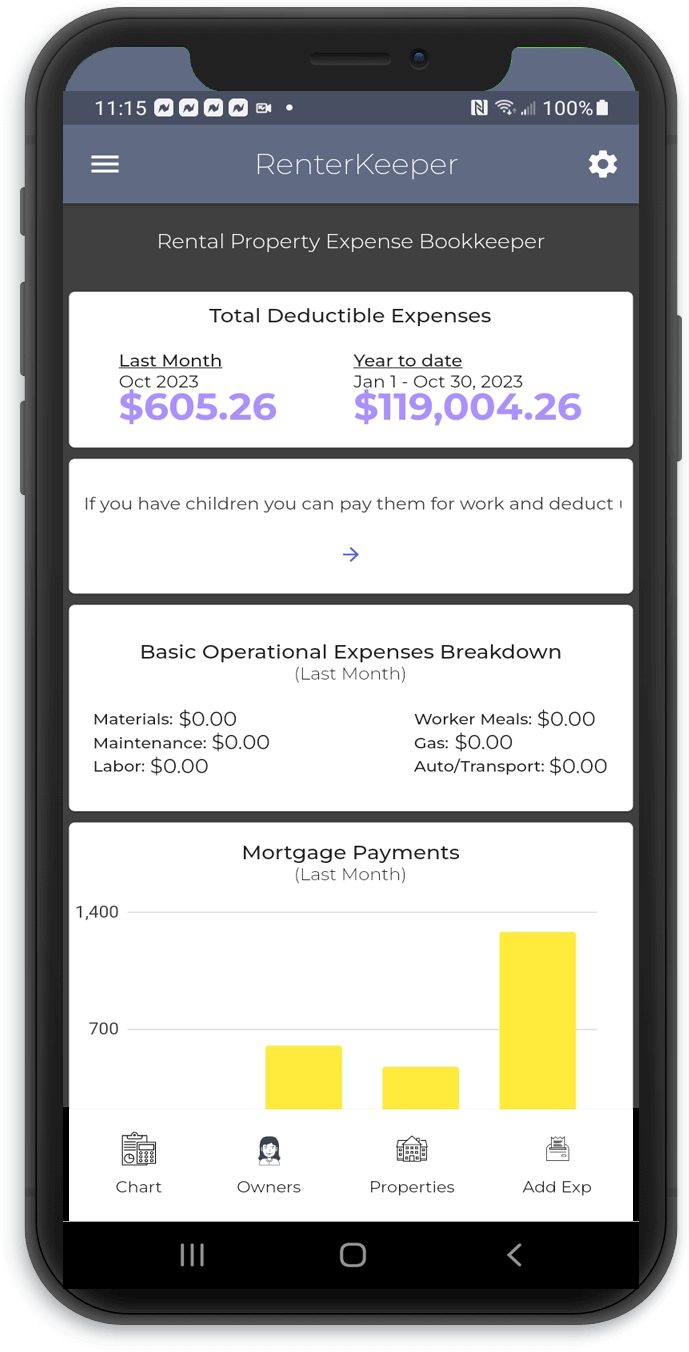

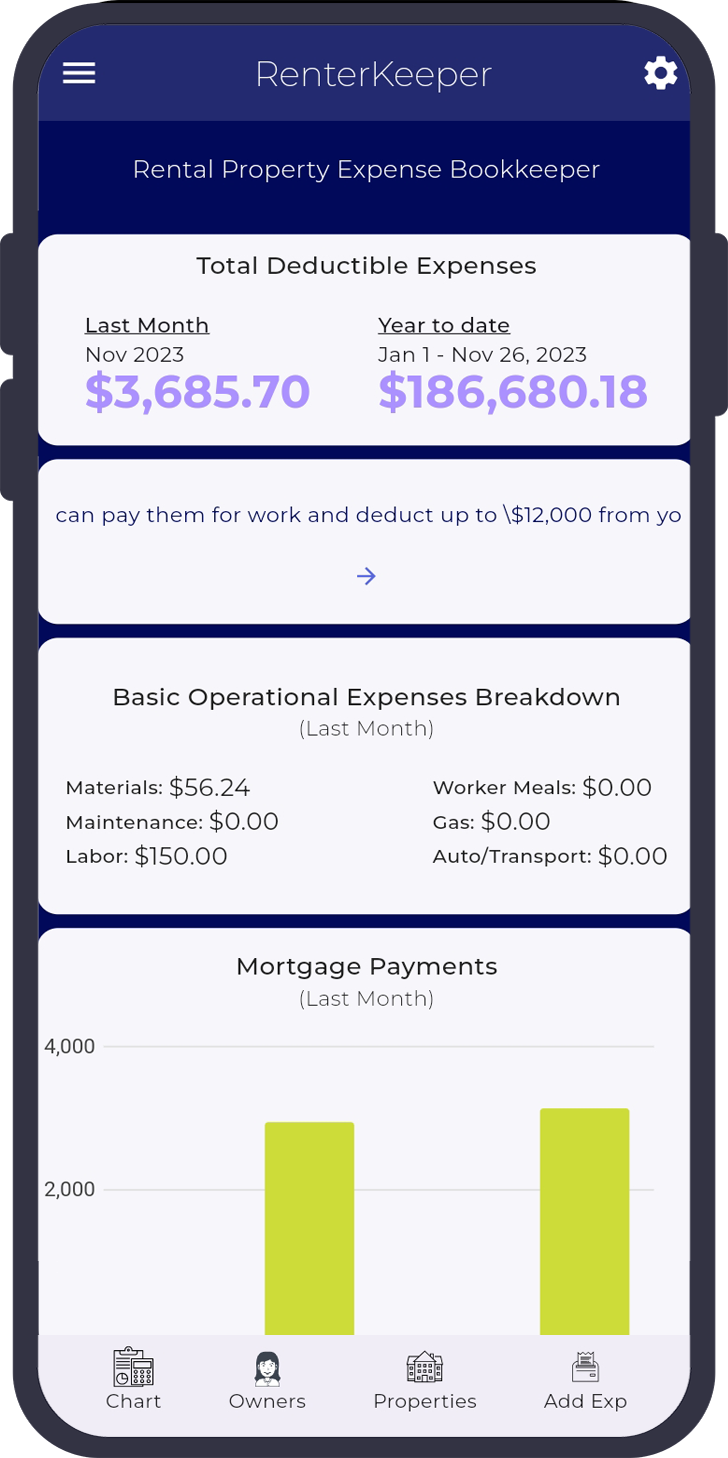

If you believe that keeping track of expenses is just as important as tracking income, RenterKeeper is perfect for you.

Discover deductions you didn't know you could take.

If you have children, did you know that you can deduct up to $12,000 if you pay your kid to help out. This is a great way to teach your child about the family business. You guys can bond while working together while saving towards a college fund.

That's just one of many, little known deductions the IRS allows, that few take advantage of.

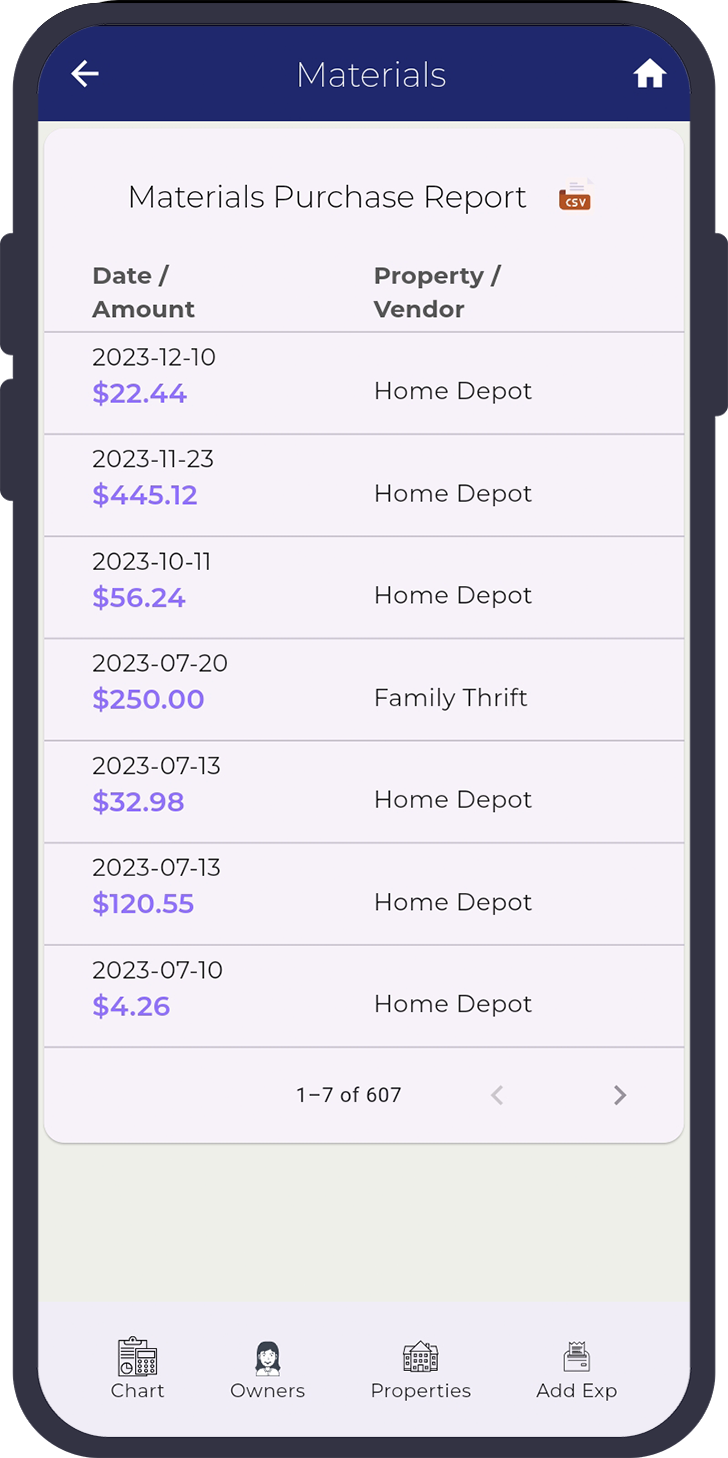

Keep track of your cash payments

You spend a lot of money in hardware stores like Home Depot. Your receipt is your only proof of your cash expenses. What makes matters worse is receipts fade. No problem. Record your transaction and upload or take a photo of your cash receipts to your RenterKeeper cloud storage for safe Keeping.

Keep it! "It's your data".

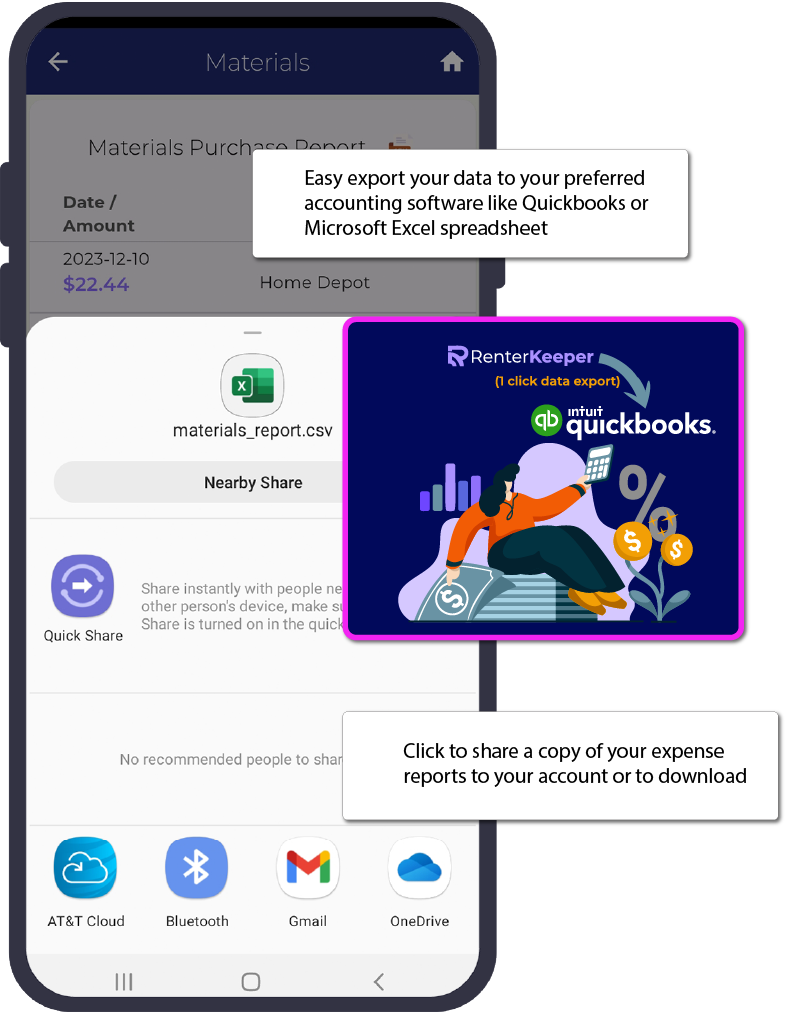

We want to help make your Bookkeeping so simple and stress free...it's "almost" fun. That means you're more likely to consistently keep accurate records. And come tax time, all there's left for you to do is to 1-click export all your data. Everythings categorized and calculated and ready to be imported into your accountants Quickbooks or preferred software.

Gallery

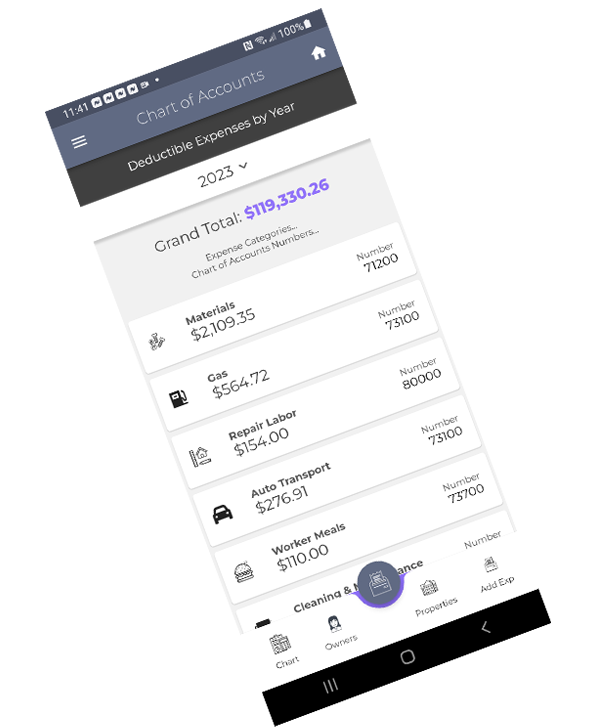

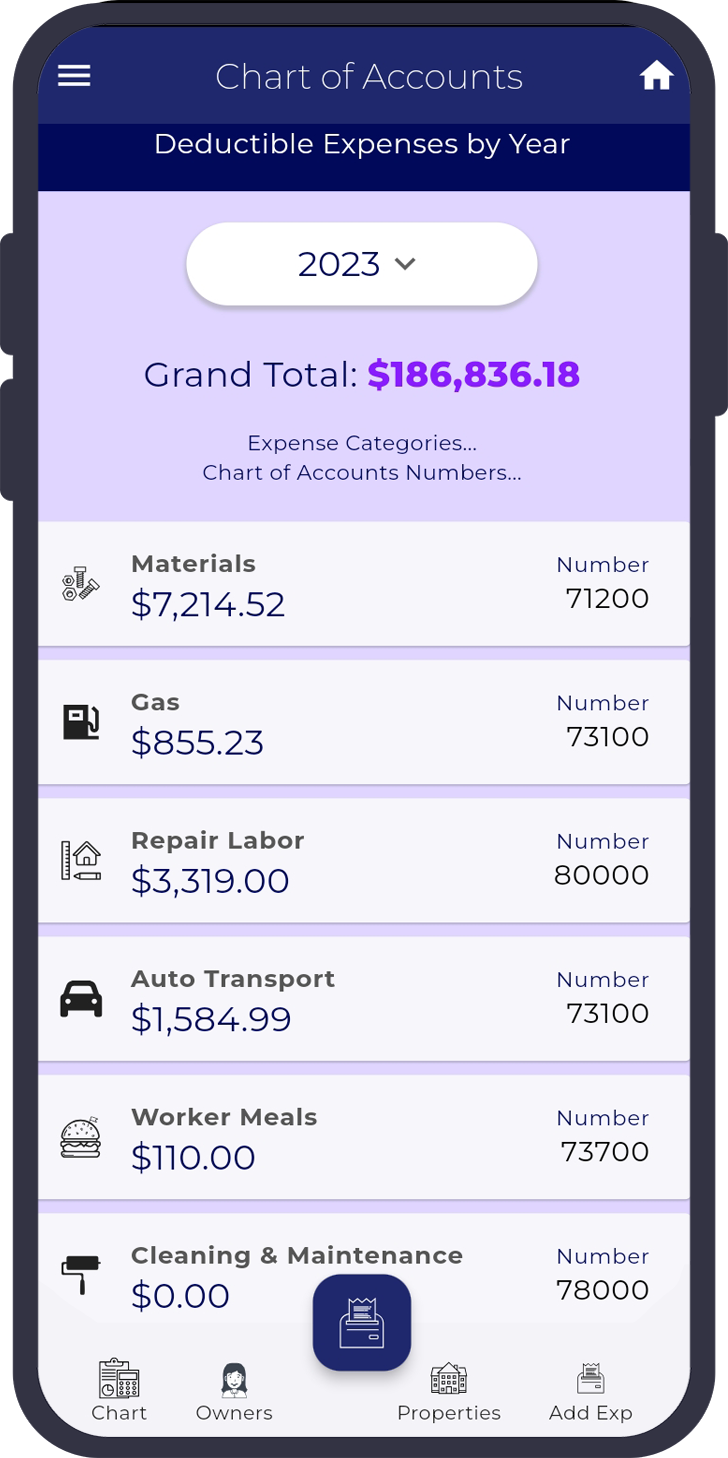

App Screenshots

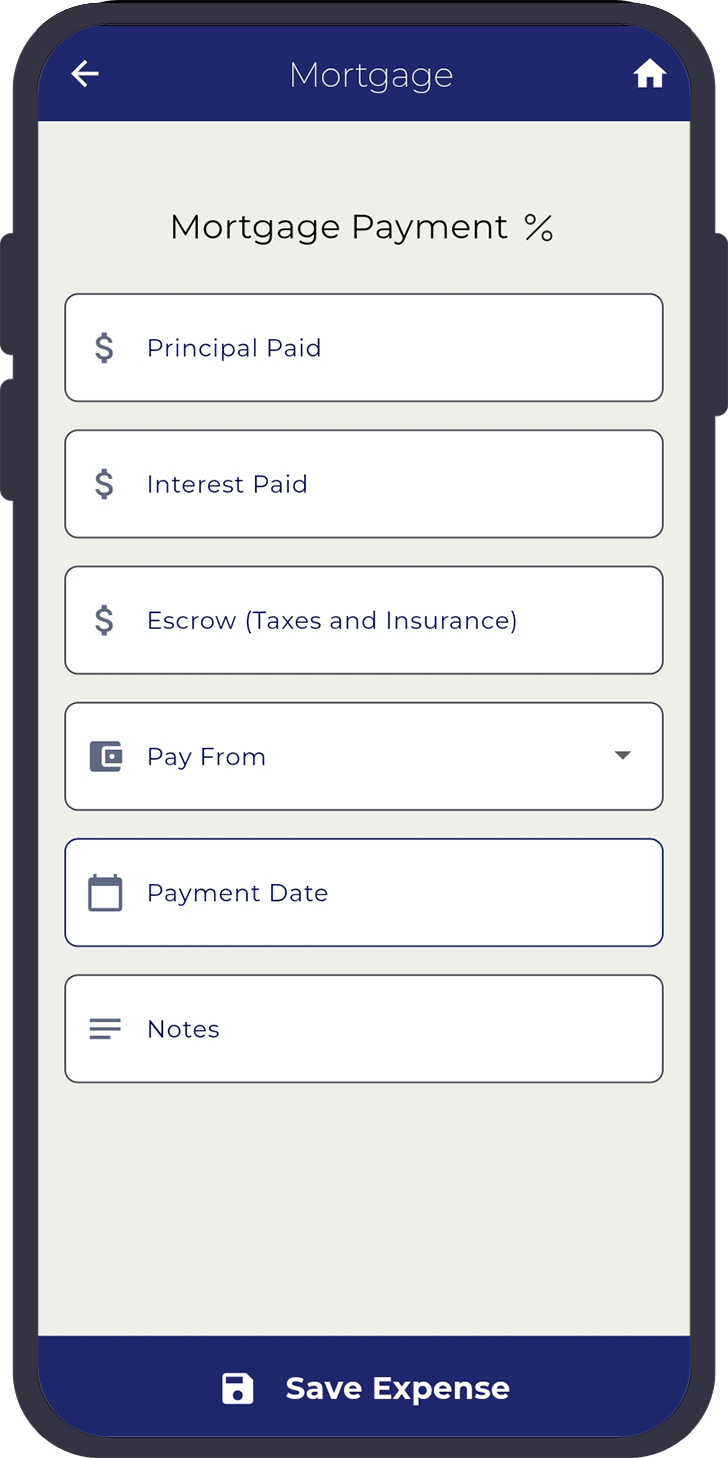

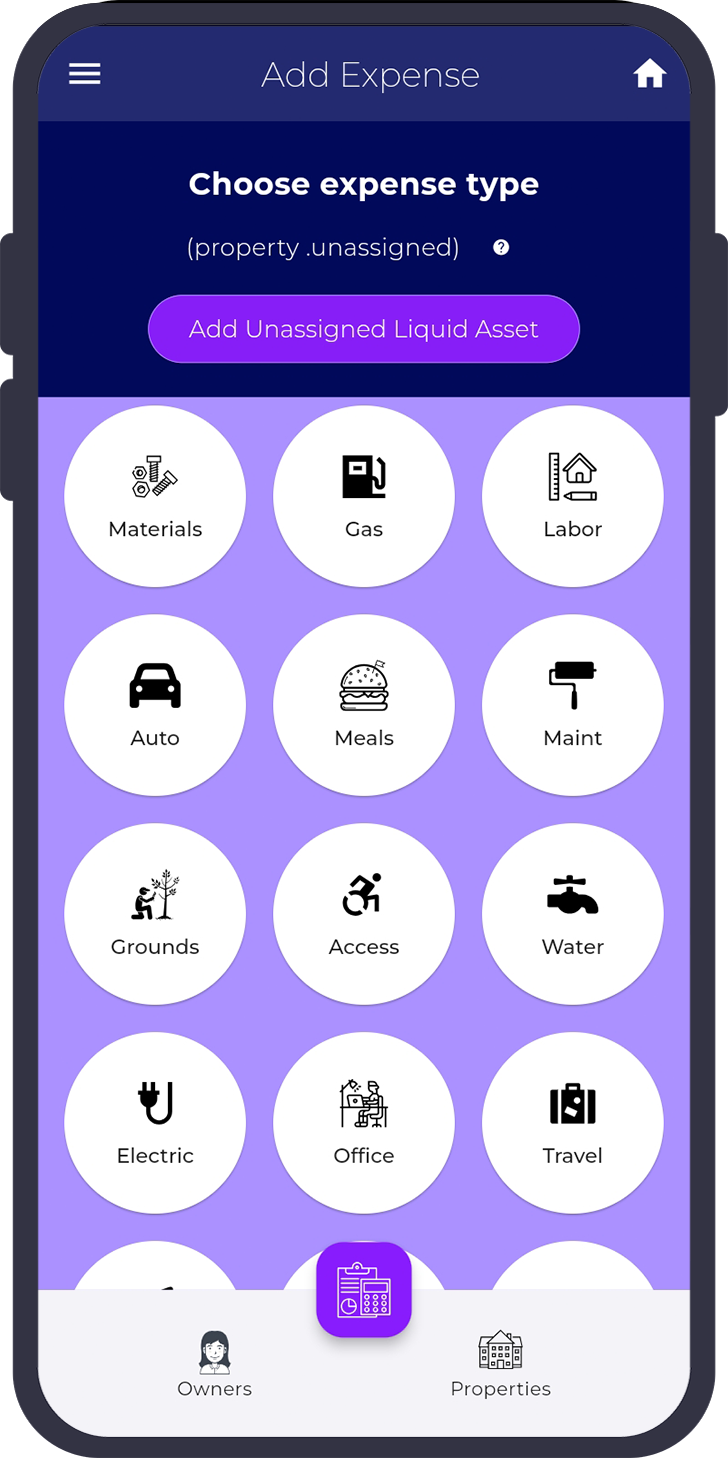

Categorize expenses by owner and property.

You get 31 tax deductible expense categories at your fingertips

- Materials (Hardware and supply stores, Home Depot, Lowe's, etc.)

- Gas (Auto Fuel)

- Labor (General labor, AC Repair, Plumbing, Electrical, Construction, etc.)

- Auto (Auto repairs,maintenance, parts, insurance, tolls, parking, roadside assistance, car note)

- Meals (Meals purchased for workers)

- Cleaning & Maintenance (Move-In/Out cleaning prep, general maintenance, etc.)

- Furniture

- Children's payment (Payment to your child for working in the family business)

- Grounds (Lawn maintenance, sprinkler system maintenance and repairs)

- Accessibility (Modifications/Construction for disabilities)

- Water Utilities

- Electric Utilities

- Office Supplies

- Appliances

- Furniture

- Accounting Fees (Accounting and Bookkeeping services)

- Computer/Internet (Computers, Computer hardware, software, and internet)

- Travel (Real estate related travel expenses)

- Marketing (Promotion, marketing, & advertising rentals)

- Legal Aid (Eviction filings, real estate attorney, process servers, etc.)

- Management Fees

- Education Fees (Real estate related education, seminars, memberships, media, etc.)

- Banking Fees (Business related service fee, wire transfer fee, safe deposit box, overdraft fee, maintenance fee, account analysis fee, paper statement fee, return item fee)

Gain Access to

Powerful Rental Property

Tax Deduction Tools

Start taking advantage of every deduction you have available. "Keeping Money is Making Money" ~ RenterKeeper.